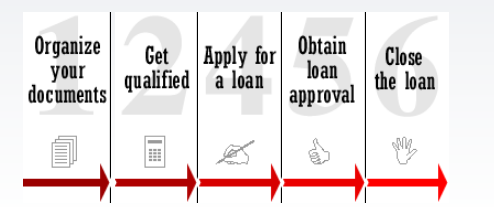

An Overview of the Loan Process

Organize Your Documents

A properly documented loan application makes your loan process go smoothly. This checklist will help you gather your paperwork.

Complete and sign the residential loan application, Form 1003, and the attached loan info sheet, credit authorization and fair lending notice. Page 4 of the application is a continuation page in case you need additional space for your assets or liabilities. If you make a mistake while filling out the application cross it out, and make a change. Do NOT use whiteout.If you are salaried: provide W-2’s for the previous two years and one month of paystubs. If you are self-employed, provide tax returns for the previous two years, including all schedules, and a YTD profit and loss statement. (Note: provide copies of all requested documents. Do not provide original documents.)If you own rental property, provide recent rental agreements and tax returns for the previous two years, including all schedules.To speed up the approval process, provide bank statements for the most recent three months, and recent statements for stock, mutual funds and IRA/401K accounts.If you are requesting a cash out refinance, provide a letter explaining how you will use the refinance proceeds.If applicable, provide a copy of your divorce decree and settlement agreement.If you are NOT a US citizen, provide a copy of your green card (front & back). If you are NOT a permanent resident provide a copy of your H-1 or L-1 visa.If any borrower has filed bankruptcy, provide the Discharge Notice, Filing and Schedule of Creditors.If you are applying for a home equity line of credit or loan (second loan), also include your first mortgage note. (This should be with your closing loan documents.)Get Qualified

Getting qualified before you apply for a loan can help you understand how much you can borrow.

When buying a home, you may be pre-qualified or pre-approved. You can be pre-qualified over the phone or on the Internet in a few minutes. Pre-qualification is not as useful as pre-approval. Pre-approval requires a more rigorous process, including verification of your credit, income, assets and liabilities. It is highly recommended that you be pre-approved before you start looking for a home.

Being pre-approved will:

Inform you of your maximum affordable home value, and save you from previewing properties outside your price range.

Put you in a stronger negotiating position with the seller, because the seller will know your loan is pre-approved.

Help you close quickly, since your loan is pre-approved.

Obtain Loan Approval

Once your loan application has been received, we will start the loan approval process immediately. This involves verifying your:

Credit history

Employment history

Assets including your bank accounts, stocks, mutual fund and retirement accounts

Property value

Based on your specific situation, additional documents or verifications may be required.

To improve your chances of getting a loan approval:

Fill out the loan application completely.

Respond promptly to any requests for additional documents. This is especially critical if your rate is locked or if you plan to close by a certain date.Do not make any major purchases. Do not buy a car, furniture or another house till your loan is closed.Anything that causes your debts to increase might have an adverse affect on your current application.Do not move money into your bank accounts unless it can be traced. If you are receiving money from friends, family or other relatives, please contact us.Do not go out of town around the closing date. If you do plan to be out of town when your loan is expected to close, you may sign a power of attorney, to authorize another individual to sign on your behalf.Notify your loan officer before applying for any other credit, including credit cards, personal loans or even with another mortgage company. Some loan programs have strict guidelines regarding your credit score. Credit inquiries may lower your credit score and may have an adverse affect on your loan approval.

Close the Loan

After your loan is approved, you will be required to sign the final loan documents. This will normally take place in the presence of a notary public. Be prepared to:

Bring a cashiers check for your down payment and closing costs if required. Personal checks are normally NOT accepted.

Review the final loan documents. Make sure that the interest rate and loan terms are what you were promised. Also, verify the accuracy of the name and address on the loan documents.

Sign the loan documents. The notary will require that you have your picture ID with you. Some lenders also require to see your Social Security card.

Your loan will normally close shortly after you have signed the loan documents. On refinance and home equity loan transactions, federal law requires that you have three days to review the documents before your loan transaction can close. Purchase transactions do not have a three day rescission period.

Merrimack Mortgage Co. Inc. (c) 2008 | Privacy policy

660 Forest Avenue Portland, ME 04103 Phone: (207) 842-6854 Ext. 227 Fax Number: (207) 842-6858